Orange County, FL

$110,000

Orange County, FL

$110,000

Hamilton County, IN

$450,000

Chesterfield, MO

$399,999

Rocklin, CA

$40,000

San Francisco, CA

$499,000

Ogden, UT

$350,000

Beverly Hills, CA

$250,000

Springfield, MI

$97,000

$2,500,000

Kingston, PA

$65,000

Available Nationwide

$500,000

Toledo, OH

$289,000

Greenville, NC

$125,000

$300,000

Mandeville, LA

Pittsburgh, PA

$50,000

Massachusetts

$3,100,000

Tina Wright, M&AMI, CBI, MBA

Transworld Business Advisors of Raleigh-Durham

Serving Wake County, NC

Tina is respected as one of the nation's top-producing business brokers in the country by several industry organizations including the IBBA and the M&A Source. Please take a moment and view our listings and our 200+ 5-Star client Google reviews. Transworld has over 45 years of experience in business brokerage, a global network of $4.5 billion in active inventory with over 6,000 business listings worldwide. Transworld Business Advisors is the world leader in the marketing and sale of businesses, franchises, and commercial real estate. Transworld offers professional services that successfully bring buyers and sellers together. From business brokerage to mergers and acquisitions, we are the business sale specialists.

New York, NY

$98,800

Pulaski County, AR

$450,000

Cuyahoga County, OH

$150,000

Colorado Springs, CO

$350,000

Owings Mills, MD

$67,000

Los Angeles, CA

$660,000

Henderson, NV

$279,000

Missoula, MT

$400,000

$345,000

Sacramento, CA

Fairfield County, CT

$235,000

Ocean Township, NJ

$110,000

Miami Beach, FL

$125,000

Ulster County, NY

$89,900

Santa Cruz County, CA

$428,000

Livonia, MI

$184,900

Troy, MI

$94,900

Cook County, IL

$280,000

North Brunswick, NJ

$545,000

Alameda County, CA

$1,950,000

$225,000

Oakland County, MI

Massapequa, NY

$119,000

Orleans County, LA

$450,000

Fayetteville, NC

$60,000

Apple Valley, MN

$1,200,000

Montgomery County, PA

$230,000

Collier County, FL

$119,000

North Richland Hills, TX

$180,000

Houston, TX

$45,000

Allison Gregory

We Sell Restaurants

Serving Arapahoe County, CO

We Sell Restaurants is the nation’s largest business broker franchise focused exclusively on the sale of restaurants. With 20 years of experience, we have helped buy, sell and lease more hospitality locations nationwide than any other brand. We Sell Restaurants has carved an unparalleled niche in the industry as the nation's leading and only business broker franchise focused on restaurants. Formed over two decades ago, We Sell Restaurants is a vibrant and innovative company that operates in 45 states nationwide and delivers on the founder's vision to Sell More Restaurants Than Anyone Else. PERIOD. Our team achieves that mission by sharing a common set of core values that include: We know that Every Day is Game Day and We Act Accordingly We Treat Each Other, Our Clients and Internal Clients by the Golden Rule We Act with Integrity and Only Make Agreements We Are Willing and Able to Keep We Are the Brand and are Passionate about Sales Results We Create a Customer Service Experience Worth Sharing With top-flight experience crafted over decades of selling restaurants, along with previous expertise working in small businesses and in senior leadership roles for a Big 5 Accounting firm and a major Fortune 100 company, We Sell Restaurants leadership has deep financial, branding and marketing experience in restaurants, and small and big business. This collective experience allowed them to take the fragmented brokerage market and build a specialized practice for selling only restaurants with a systemic approach never before seen in the industry. We Sell Restaurants has recruited an experienced leadership team with experience spanning decades in business brokerage, franchise sales and customer service and operations.

Plymouth County, MA

$57,000

Eugene, OR

$150,000

$11,250,000

Riverside County, CA

Mt Juliet, TN

$149,900

Anacortes, WA

$89,000

Las Vegas, NV

$180,000

Austin, TX

$175,000

Las Vegas, NV

$150,000

Orlando, FL

$283,000

Hackensack, NJ

$445,000

Barnwell County, SC

$328,000

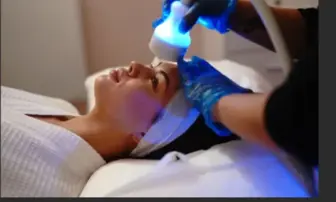

The United States massage therapy industry has grown by leaps and bounds in the last decade. The job outlook or projected percent change for the next decade is 22, much faster than the average for all occupations! Massage therapists work in a variety of professional settings, including their own office or home, health care facilities, spa and leisure venues, and client's offices or homes. Sole or self-employed practitioners are the largest group of therapists.

If you're ready to buy a massage business, know that experts expect the industry to continue to grow. In the last five years, almost 60 million Americans received at least one massage, which led to industry revenue growth of approximately 4 percent. Experts expect this trend to continue because of the aging baby boomer population, which will desire more treatment in the years to come.

Data shows that the primary reason people give for a massage is medical, followed by reasons for relaxation and stress reduction, pain relief or management, muscle soreness, recovery or rehabilitation, pampering, well-being, and health. If you're actively looking for a massage business to buy, keep the following factors in mind:

Massage industry pundits expect massage therapy opportunities to increase with an increase in disposable income. Therefore, if you're interested in massage businesses for sale, it's a good idea to think about the specialized or value-added services you can bring to the table.

Whether you wish to focus on pain relief or relaxation massage, do your research on the potential client base and the feasibility and cost of offering these types of services at your office or off-site.